How much does it cost to register a car in NY? It depends on whether you’re the vehicle’s first or second owner. First owners are required by law to fork out MTCD and vehicle plate fee, apart from other charges, at the time of registration. That isn’t the case for second owners who can go without paying both.

There is similar confusion regarding the payment of sales tax. The NY Department of Motor Vehicles states that people who have already paid sales tax at the time of purchase of the vehicle – or those whose cars are exempt, need not pay it at the time of registration. Others aren’t as lucky.

Typical fees when registering a car in NY

You must pay the following fees at the time of registering your car:

Registration fee

New York charges car owners a specific amount to register their vehicles under their name. The registration fees begin at $26 for a car that weighs under 1,650 lbs. Vehicle owners whose car weighs more than 1,650lbs are required to pay $1.5 for every additional 100lbs.

Unlike some states that charge an additional fee for electric vehicles, NY charges a flat registration fee, whether you intend to register an electric vehicle or one that runs on fossil fuels. However, it does require residents of some counties to pay a supplemental fee at the time of registration.

Vehicle plate fee

You’re given three options when applying for car registration in New York. The first of them let you apply for a new registration as well as vehicle plates. The second option is that of applying for the transferring of registration and plates from another car.

The third option, meanwhile, lets you apply for transferring vehicle registration but with new number plates. Depending on the option you’re going to select, you’ll have to pay a different vehicle plate fee you can calculate by going to this page.

County use tax

Several counties in the NY state, including New York City, have enacted local laws or ordinances to collect vehicle use taxes. These laws have authorized NY DMV to collect the vehicle use tax from the residents of the county on behalf of their locality.

Here’s how much vehicle use tax you may have to pay:

- For counties inside NY City: Residents of the Bronx, Kings (Brooklyn), Queens, Richmond (Staten Island), and New York (Manhattan) are required to pay $30 every two years in the form of car use tax.

- For counties outside NY City: Their residents are required to pay only $10 every two years in lieu of car use tax, as long as their car’s weight doesn’t exceed 3,500lbs– in which case the vehicle use tax will be double.

Sales tax

Upon registering your vehicle in New York, you must either pay its sales tax at the DMV office or give receipts showing it was already paid. There is a third option for those of you who can prove that their vehicle is exempt from sales tax at the time of registration.

The state of New York charges a 4% sales tax for registering a new vehicle. Remember that this estimate doesn’t include any city or county sales taxes that may also apply. Such taxes could be as steep as 4.75%, thereby forcing you to pay 8.75% in lieu of sales tax.

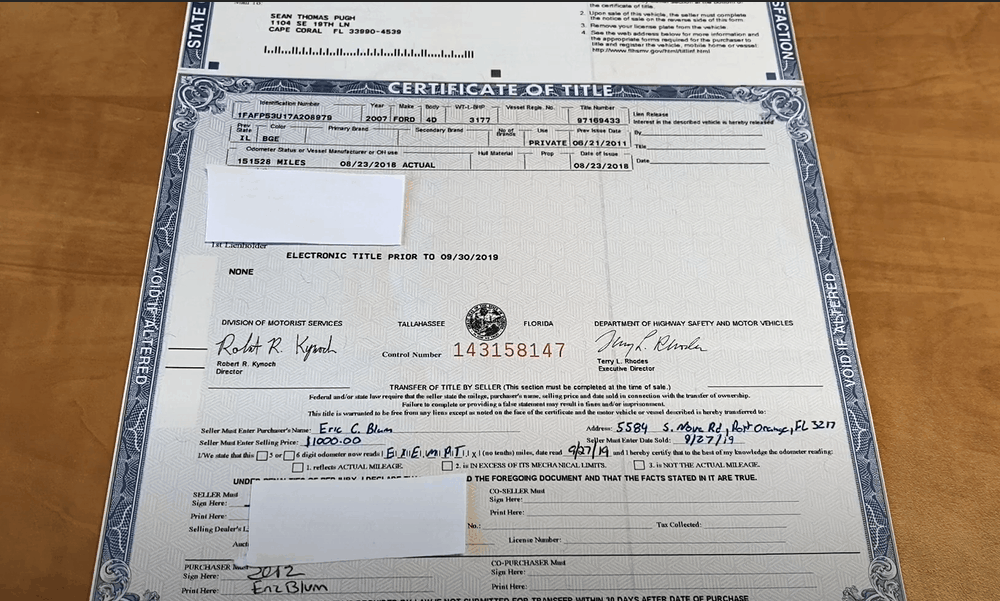

Title certificate fee

Most of you might already know what the title certificate is all about. It is a legal document that contains the name of the car’s owner. Those of you who’re buying a brand new vehicle will get the title certificate from either the dealership or the DMV. Others will get it from the car’s first owner.

The title certificate also includes the name of ‘lienholders’. These are persons who lent the money using which the car owner bought the vehicle. The NY DMV states that most motor vehicles of the model year 1973 and after must be titled, and it charges $50 for a title certificate fee.

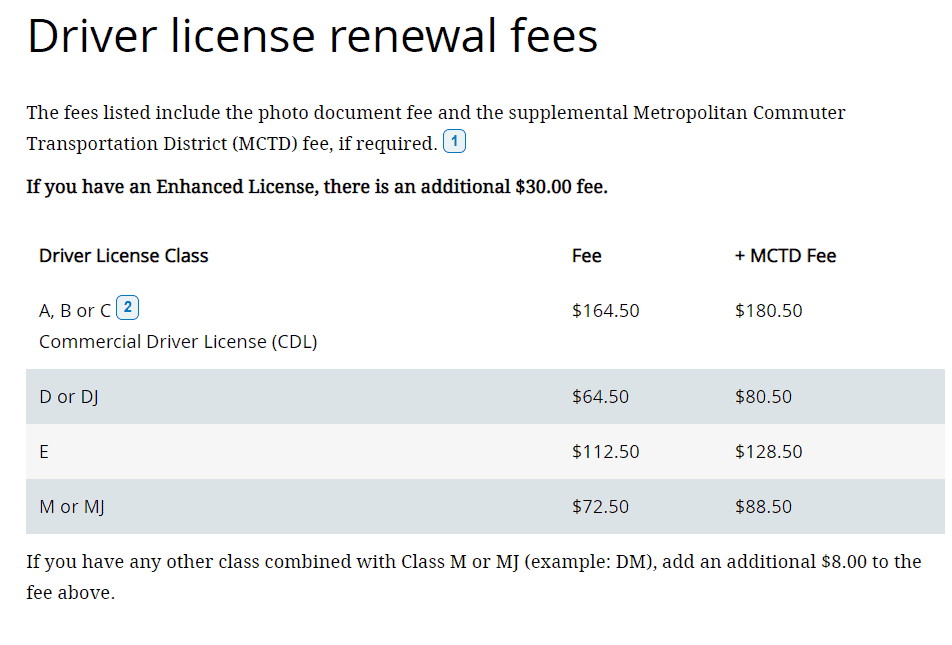

MCTD fee

The New York Department of Motor Vehicles mandate residents of several counties to pay an additional Metropolitan Commuter Transportation District (MCTD) fee. The counties include Bronx, New York, Queens, Richmond, Suffolk, Westchester, Putnam, Orange, Nassau, Rockland, and Dutchess.

MTCD fee varies on the length of time your driver’s license will be in effect. Car owners whose driver license will remain valid for less than 8-years will pay $1 in MCTD fee every six months. Those who hold an 8-year license fee have to pay $16 at once at the time of registration of their vehicle.

How much does it cost to register a car in NY?

Depending on the weight of your vehicle, whether you’re its first or second owner and other factors mentioned above, registering a car in NY might set you back at least $45.50 in NY. The figure is reliable, but you’d still do well to check with NY DMV to know the exact amount.

Conclusion

The fact that you have made it this far means you already know how much it costs to register a car in NY. Various factors contribute to the amount quoted above, including registration fee, vehicle plate fee, county use tax, sales tax, title certificate fee, and MCTD fee.

All these factors are so diverse that it’s difficult to give you an exact quote of any car’s registration fee in New York. That is why we recommend that you check out the state’s Department of Motor Vehicle’s website to estimate for yourself how much does it cost to register a car in NY.

Provided you do that, you won’t have to make any last-minute arrangements for arranging more money than you carried with yourself to the DMV office. That will save you a lot of time which you can exploit to drive your car.

The post How much does it cost to register a Car in NY appeared first on Smart Motorist.

source https://www.smartmotorist.com/how-much-does-it-cost-to-register-a-car-in-ny

No comments:

Post a Comment